SWIM WITH THE SHARKS PITCH COMPETITION

Program Timeline

- Application closes on August 1, 2023, at 11:59 p.m.

- Open to for-profit businesses within the New Castle County Chamber of Commerce traditional service areas

- Has been in business fewer than five (5) years

- Entrants MUST have a valid business license at the time of submission

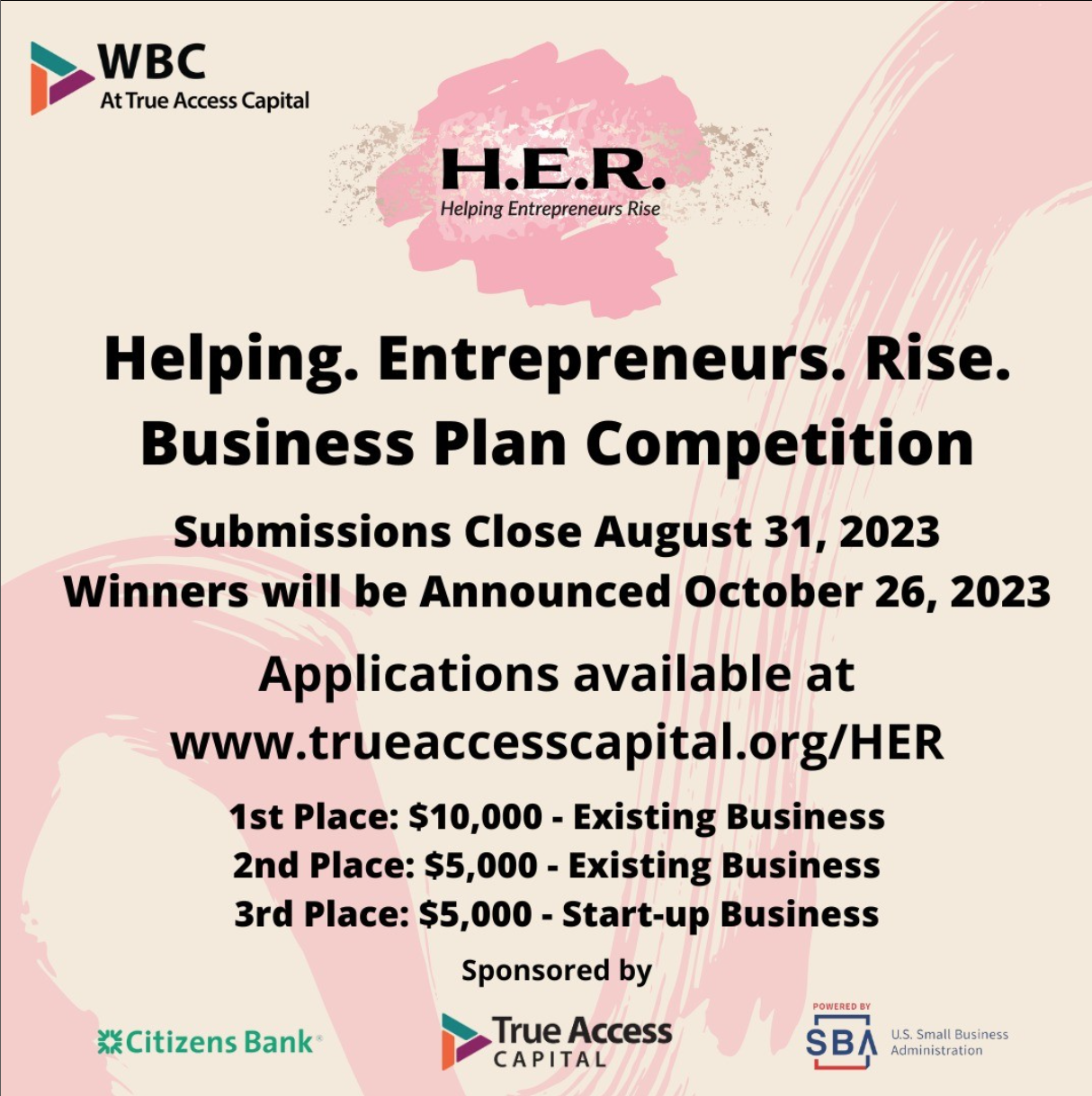

HELPING. ENTREPRENEURS. RISE. BUSINESS PLAN COMPETITION

Women are in the forefront of Entrepreneurship with approximately 58{d887f3b52e2c15f1a529fa99582df65ba6c6efe27e015595ae692dd0bff64cce} of businesses being women owned.

The Womens Business Center at True Access Capital strives to assist in the growth of small businesses and women entrepreneurship.

The H.E.R Business Plan Competition main purpose is to help improve and grow sustainable businesses through the development of a strong, functional business.

Where To Find Small Business Financing

Check back regularly. More content is coming soon.Â